Required Filings & AOS Notifications

Various filings with the Auditor of State’s (AOS) Office are required by statute. The information below provides an overview of each required filing or notification, with information about how to meet the requirements.

Notification of Creation or Dissolution of Public Offices, Council of Governments, Change in Fiscal Officer, or Warrant Issued Under Protest

Ohio Revised Code §117.10(E) – (other than a Regional Council of Governments, which should follow the instructions in the next section) states, “Within 30 days after the creation of any public office, that public office shall notify the auditor of state in writing that this action has occurred.”

What to do...

Email AOS Regional Office by clicking on the corresponding region below and include the following information:

Subject line: Creation of a Public Office

Include in the email:

- Public office’s name

- Public office’s county

- Fiscal officer’s name

- Fiscal officer’s email and phone number

- Date of public office’s creation

- The bylaws, resolutions, etc., governing the creation of the public office

Ohio Revised Code §167.04(D)(1) states, “The officers of

the council shall notify the auditor of state of the regional council's formation, provide a copy of the

council's by-laws, and provide on a form prescribed by the auditor of state any other information regarding the regional

council that the auditor of state considers necessary.

"The council shall take no official action, other than formation, before notifying the auditor of

state of its formation in accordance with this section. Any official action the council takes

before making that notification, including entering into any contract, is void.”

Additionally, ORC §117.10(E) requires: “Within thirty days after the creation of any public office, that public office shall notify the auditor of state in writing that this action has occurred.”

In other words, before transacting any business, a council of governments needs to register with the AOS within 30 days after its creation.

What to do...

To register a regional council of governments, go to the Registration page

Ohio Revised Code §117.10(E) states, “Within 30 days after the dissolution or winding up of the affairs of any public office, that public office shall notify the auditor of state in writing that this action has occurred.”

What to do...

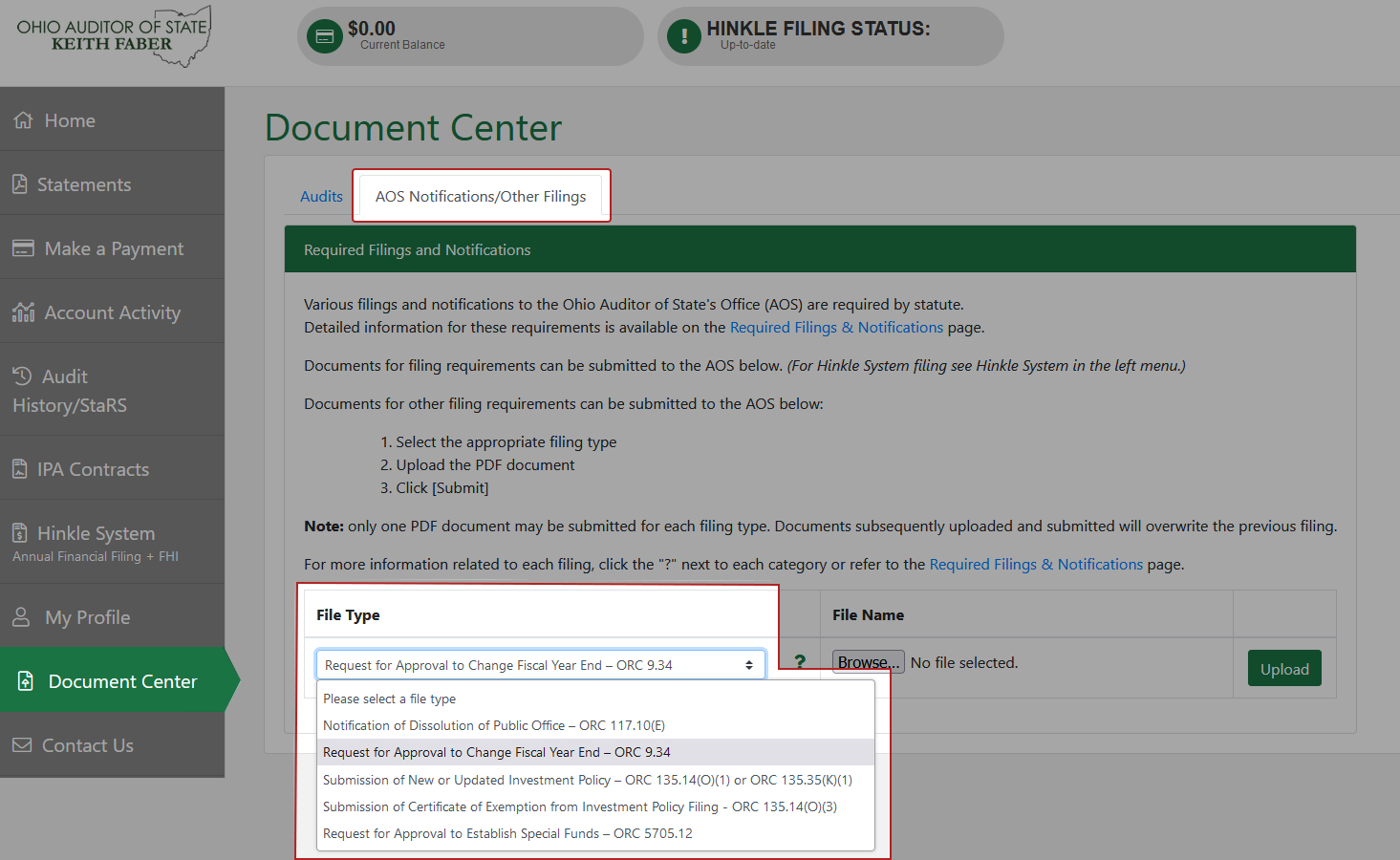

To notify the Auditor of State’s Office,

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Notification of Dissolution of Public Office – ORC 117.10(E)" from the dropdown menu.

- Under File Name find and select your PDF. Then click [Upload] when you are ready to submit your document notifiying AOS of the dissolution.

You must inform the Auditor of State’s Office when a public office (or other entity for which the AOS provides services) has a change in fiscal officer.

When a fiscal officer leaves office, Ohio Revised Code §117.171 requires the outgoing fiscal officer to complete a Certificate of Transition and provide it to the successor fiscal officer (or the appointing authority, if a successor has not been appointed). The outgoing fiscal officer also needs to provide the new fiscal officer access as an eServices contact for the entity. (Auditor of State Bulletin 2021-005 discusses these requirements.)

What to do...

If the outgoing fiscal officer fails to provide eServices access to the successor fiscal officer, the AOS should be notified of a change in fiscal officer by one of the following two methods:

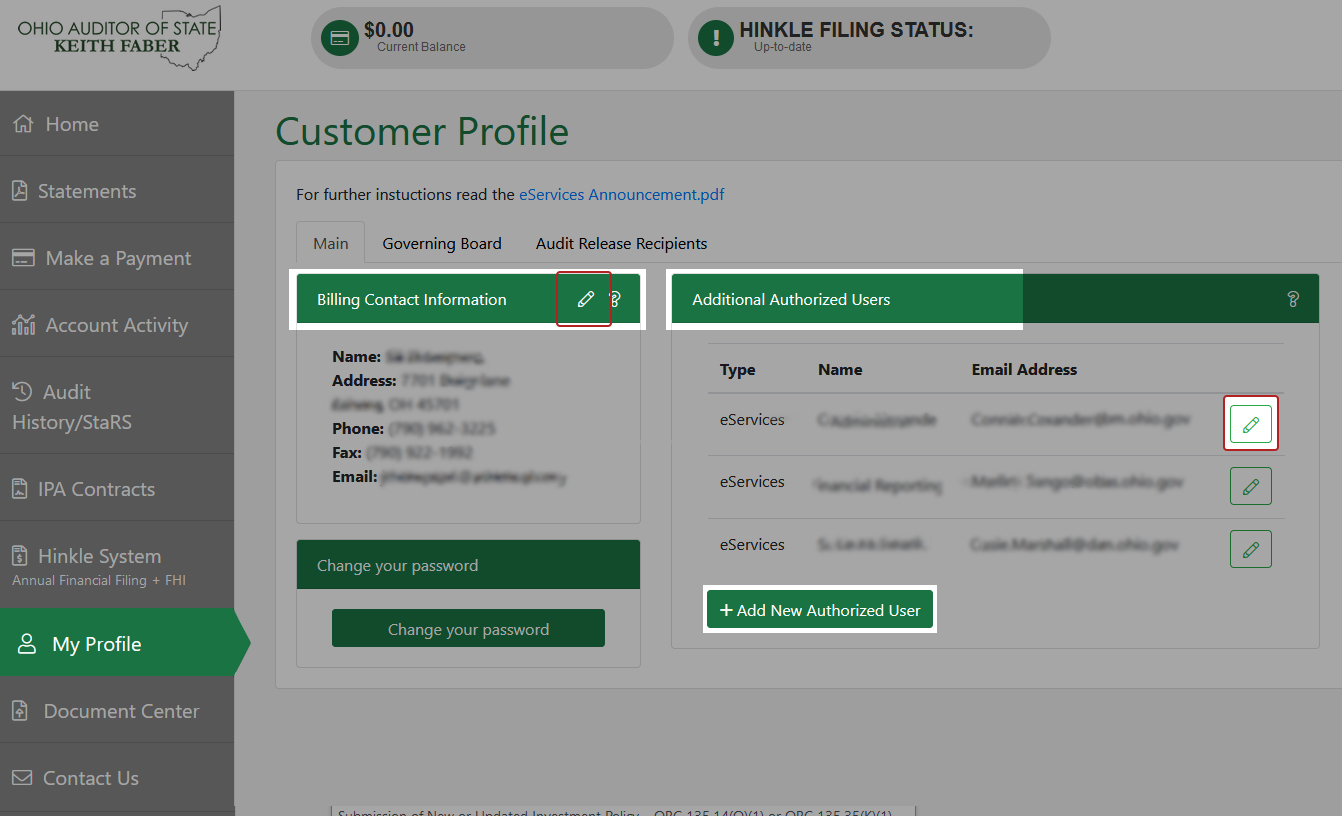

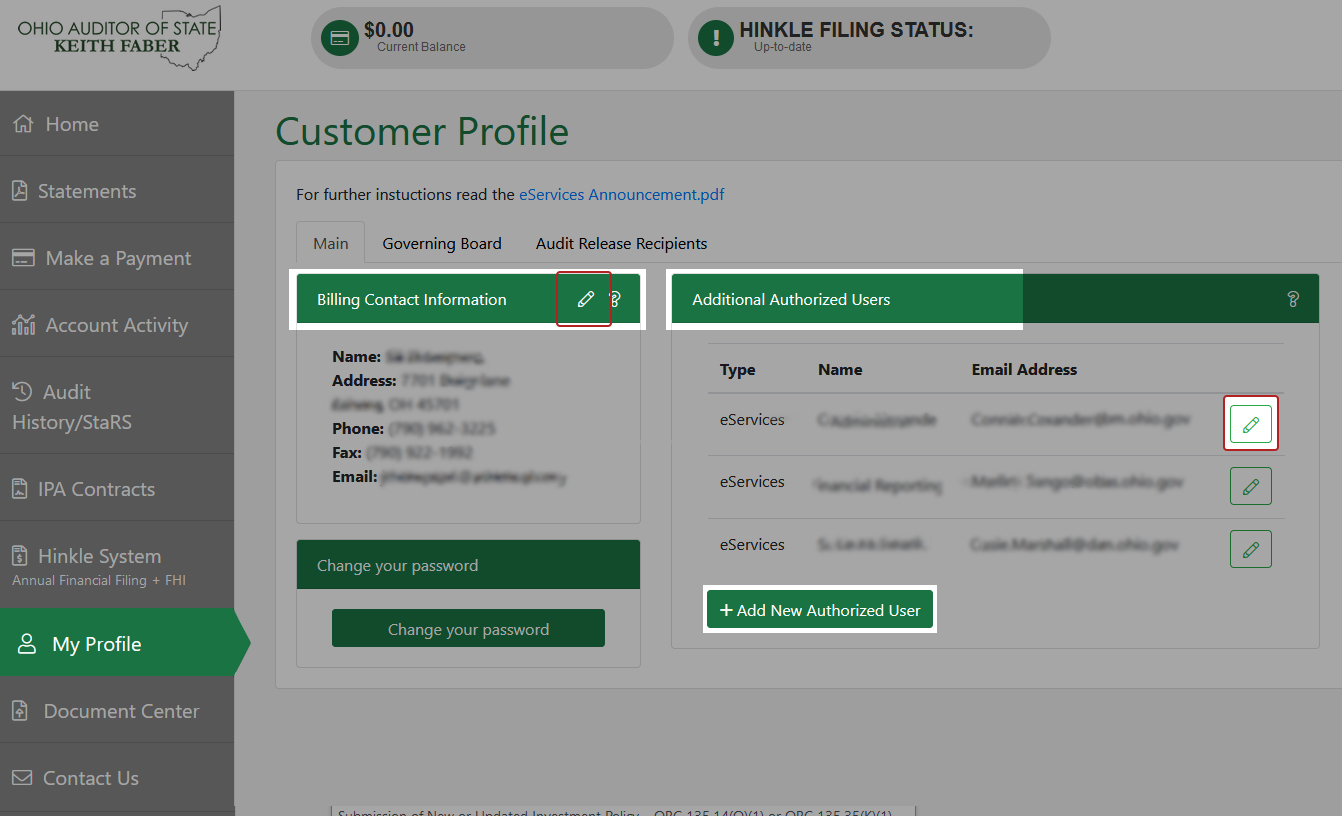

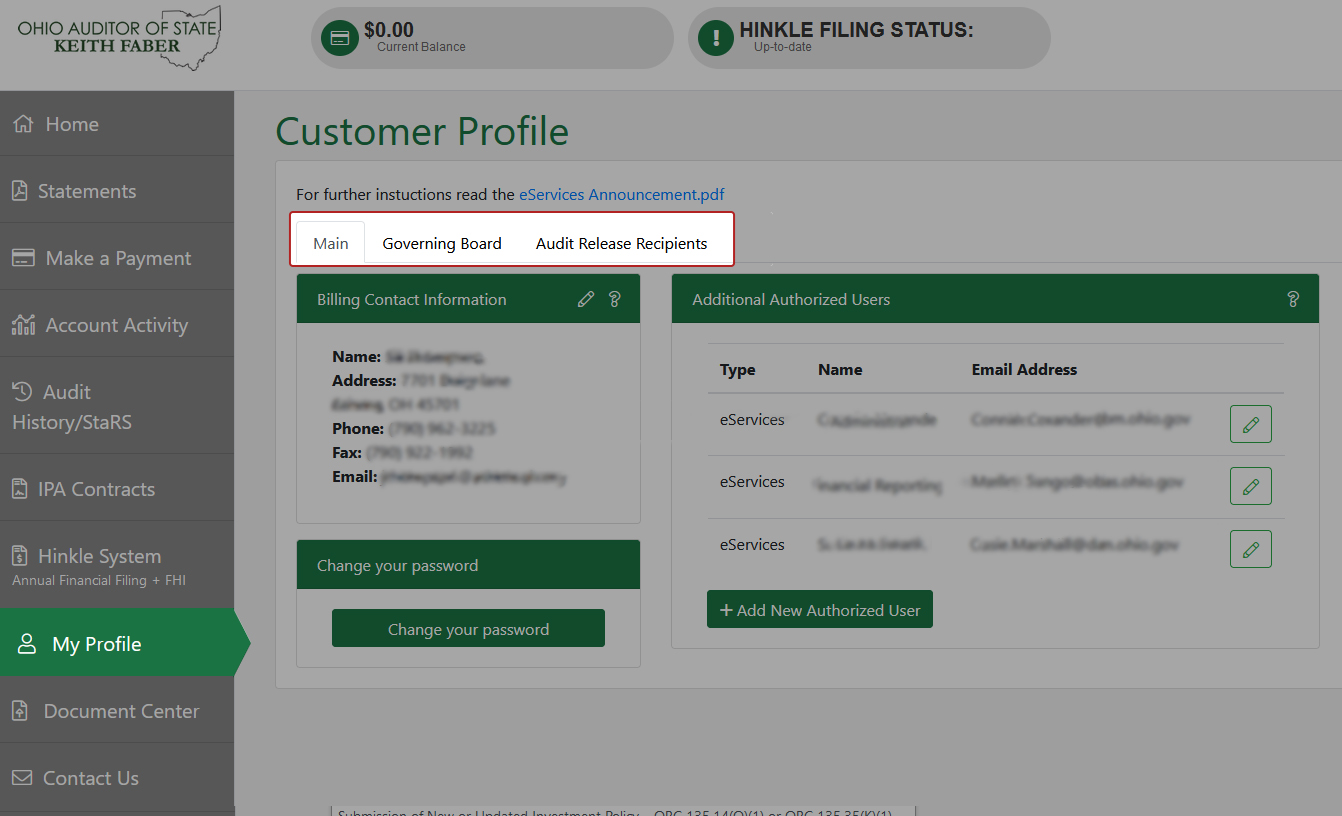

Option 1. eServices – If your entity has an additional authorized user with access to the eServices portal, have them login and update the entity contact with the new fiscal officer’s contact information. (See the steps below.)

Note: If your entity does not have an additional authorized user then scroll down to option 2.

To update this Information folow these steps:

- Log on to your entity’s eServices account.

- Select "My Profile" in the left menu.

- Find the pencil icon to edit the entity’s “Billing Contact Information”.

- Be sure to [Save] the information before navigating away from the page.

Note: The “Billing Contact Information” user is the AOS’s main entity contact for your entity.

- The new fiscal officer should also verify all other contact information is current and complete on the Main, Governing Board, and Report Release Recipients tabs on this page.

Option 2. Email the AOS Regional Office by clicking on the corresponding region below and include the following information:

Subject line: Change in Fiscal Officer

Include in the email:

- Public office’s name

- Public office’s county

- New fiscal officer’s name

- New fiscal officer’s email and phone number

- If applicable, any change in fax number or entity address

Note: Whether you are an outgoing fiscal officer or a newly incoming fiscal officer both the following pages cover the requirements in more detail, and offer helpful tools for your process.

Ohio Revised Code §319.16(D) – County Auditor issuing and recording – court warrant under protest (Effective 4/7/2021)

(D) “If the auditor questions the validity of an expenditure under division (A)(2) of this section that is within available appropriations, the auditor shall notify the court that presented the documents, shall issue the warrant under protest, and shall notify the auditor of state of the protest. When a warrant is issued under division (D) of this section, the auditor has no liability for that expenditure. If the auditor refuses to issue the warrant, a writ of mandamus may be sought. The court shall issue a writ of mandamus for issuance of the warrant if the court determines that the claim is valid.”

Upon receiving notification that a county auditor has filed a warrant under protest, per ORC §117.116, the auditor of state may review that warrant as part of the next regularly scheduled audit of the public office.

What to do...

Email AOS Regional Office by clicking on the corresponding region below and

include the following information:

Subject line: Notification of issuance of court expenditure warrant under

protest

Include in the email:

- County’s name

- County Auditor's name

- County Auditor's email and phone number

- Warrant date, warrant #, warrant amount, warrant vendor, and purpose of expenditure

- Description of why the warrant is under protest

- A copy of supporting documentation

Removal Process

For information on how to submit Fiscal Integrity Act affidavit and evidence to AOS, go to the bottom of the Fiscal Integrity Act page

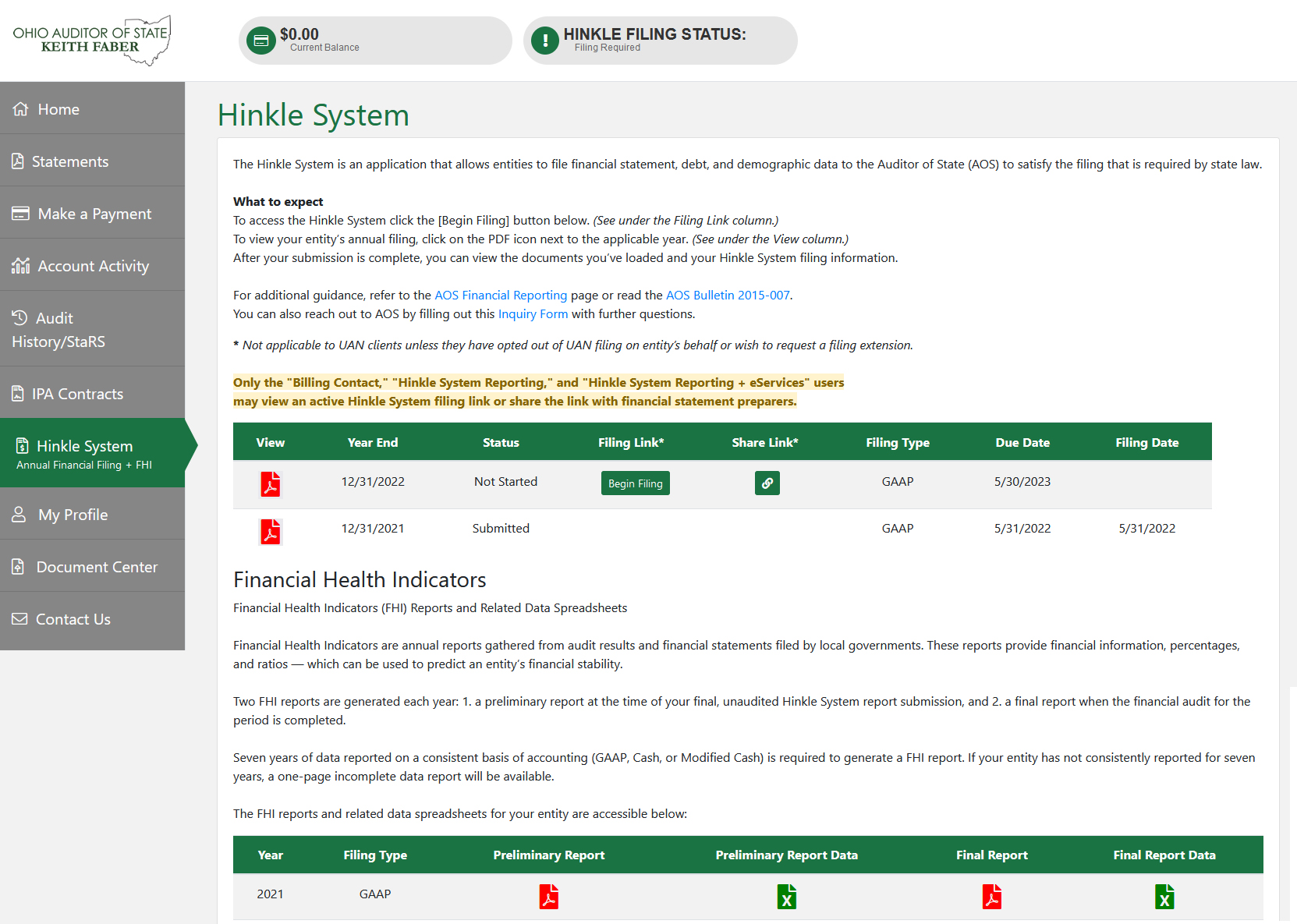

Hinkle System Financial Reporting Requirements

Ohio Administrative Code (OAC) 117-2-03(B) and Ohio Revised Code (ORC) 126:3-1-01, §117.38, §1724.05, and §1726.11 describe financial reporting requirements for all entities, including state universities and colleges, development corporations, and community improvement corporations

What to do...

All entities required to file annually with the Auditor of State must file via the Hinkle System.

What that means...

To access the Hinkle System log into your entity’s eServices account.This will be available to the entity’s fiscal officer/designated contact after the end of the reporting period.

- Login to access your eServices account.

- Once you have logged in, look for "Hinkle System" in the left menu.

- Then click the [Begin Filing] button. (See under the Filing Link column.)

Note: The “Share Link” can be used to share the filing link with a GAAP or other financial statement preparer.

-- Only the entity’s “Billing Contact” and/or the “Hinkle System Reporting” or “Hinkle System Reporting + eServices” contact can access the filing link or share the link with others.

-

More guidance can be found directly on the

Financial Reporting

- This page also covers how to file an extension to the due date.

- AOS Bulletin 2015-007 discusses these requirements in more detail as well.

Ohio Revised Code (ORC) §9.34 states:

(A) "The fiscal year of the state, every school district, and, beginning July 1, 2013, the city of Cincinnati, shall begin on the first day of July of each calendar year and end at the close of the thirtieth day of June of the succeeding calendar year. The fiscal year of every school library district, and all political subdivisions or taxing units except school districts and the city of Cincinnati, and every officer, department, commission, board, or institution thereof, shall begin at the opening of the first day of January of each calendar year and end at the close of the succeeding thirty-first day of December...

(B) "Nothing in this section prohibits a subdivision, other than a school district or county school financing district, from using a different fiscal year or other fiscal period for one or more of its funds."

As long as generally accepted accounting priciples are used, a subdivision may request to use a different fiscal year. The request needs to be approved by the subdivision's fiscal officer and by the Auditor of State.

If a subdivision uses a different fiscal year or period under this section, the Auditor of State still might require the subdivision to maintain financial reports or statements in line with the fiscal year described in paragraph (A) above.

What to do...

To request a change in the reporting fiscal year end, you must provide a letter addressed to the Auditor of State’s Chief Deputy Auditor that includes the requested fiscal year-end change and the reason for the change. This letter must be on the subdivision’s letterhead, signed by the entity’s fiscal officer and chair of the legislative body, and saved as a PDF.

To notify the Auditor of State’s Office,

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Request for Approval to Change Fiscal Year End – ORC 9.34" from the dropdown menu.

- Under File Name find and select your PDF. Then click [Upload] when you are ready to submit the fiscal year-end change request.

Investments

Investing Interim Moneys of Public Subdivisions – Ohio Revised Code (ORC) §135.14(O)

(O)(1) Except as otherwise provided in divisions (O)(2) and (3) of this section, no treasurer or governing board shall make an investment or deposit under this section, unless there is on file with the auditor of state a written investment policy approved by the treasurer or governing board.

(2) If a written investment policy described in division (O)(1) of this section is not filed on behalf of the subdivision with the auditor of state, the treasurer or governing board of that subdivision shall invest the subdivision's interim moneys only in interim deposits pursuant to division (B)(3) of this section or interim deposits pursuant to section 135.145 of the Revised Code and approved by the treasurer of state, no-load money market mutual funds pursuant to division (B)(5) of this section, or the Ohio subdivision's fund pursuant to division (B)(6) of this section.

County Inactive Monies – Ohio Revised Code §135.35(K)

ORC §135.35(K)(1) – “Except as otherwise provided in division (K)(2) of this section, no investing authority shall make an investment or deposit under this section, unless there is on file with the auditor of state a written investment policy approved by the investing authority.”

What to do...

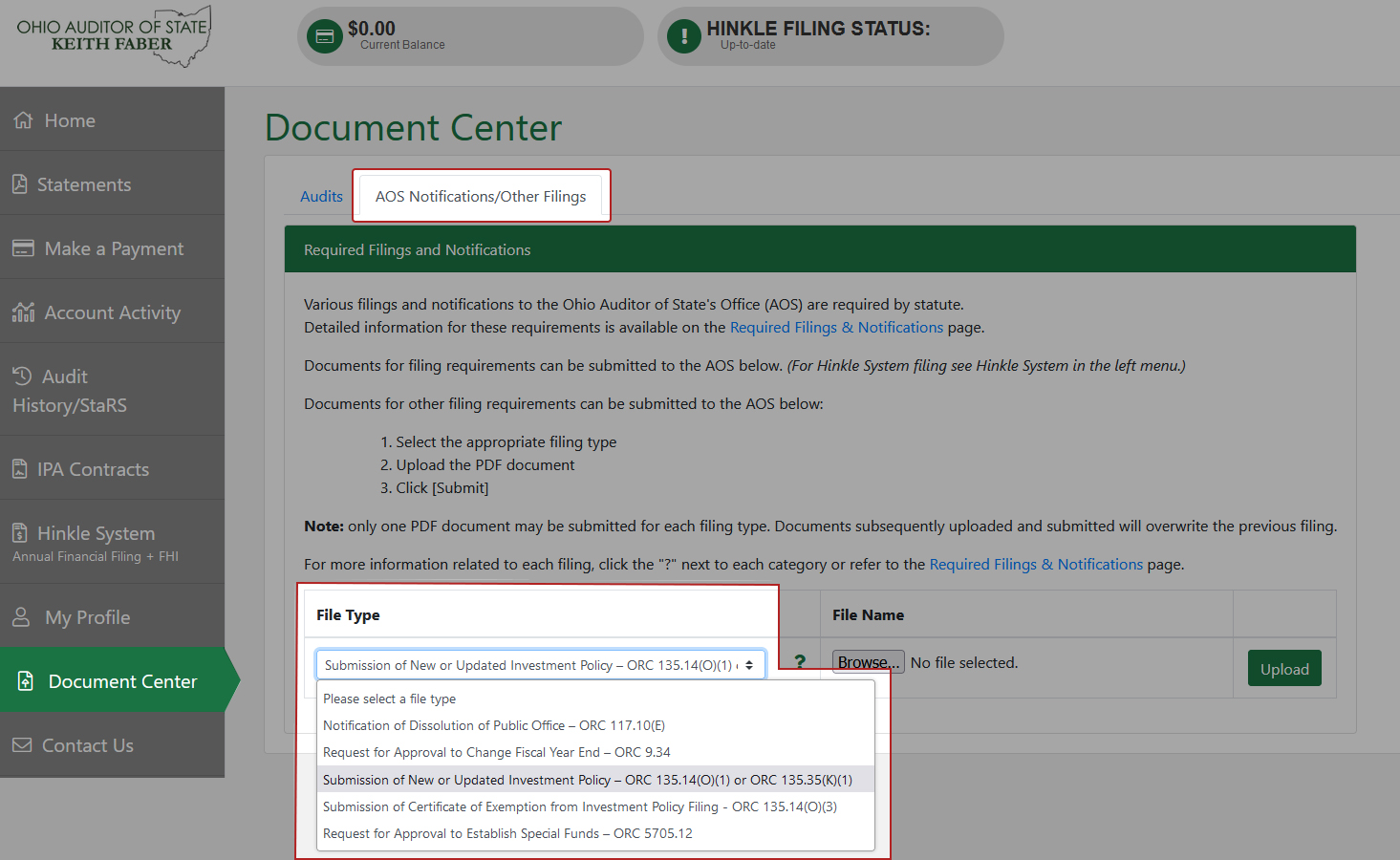

To submit your entity’s new or updated investment policy — ORC §135.14(O)(1) or ORC §135.35(K)(1) — to the AOS, follow these steps:

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of New or Updated Investment Policy – ORC 135.14(O)(1) or ORC 135.35(K)(1)" from the dropdown menu.

- Under File Name find and select your document notifiying AOS of the investment policy. Then click [Upload] when you are ready to submit.

Note: If your entity has already submitted its investment policy to the AOS, there is no requirement to resubmit unless the policy has been modified.

Investing Interim Moneys of Public Subdivisions – Ohio Revised Code (ORC) §135.14(O)

(3) Divisions (O)(1) and (2) of this section do not apply to a treasurer or governing board of a subdivision whose average annual portfolio of investments held pursuant to this section is one hundred thousand dollars or less, provided that the treasurer or governing board certifies, on a Certificate of Exemption.docx prescribed by the auditor of state, that the treasurer or governing board will comply and is in compliance with the provisions of §135.01 to §135.21 of the Revised Code.

What to do...

To submit your entity’s Certificate of Exemption from investment policy filing – ORC §135.14(O)(3) – which indicates the average annual portfolio is $100,000 or less, and your entity’s agreement to fully comply with the provisions of ORC §135.01 to §135.21, follow these steps to the Document Center and upload your exemption documentation.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of Certificate of Exemption from Investment Policy Filing – ORC §135.14(O)(3)" from the dropdown menu.

- Under File Name find and select your exemption request. Then click [Upload] when you are ready to submit.

Note: If your entity has already submitted a Certificate of Exemption from investment policy filing to the AOS and the situation has not changed, there is no need to resubmit unless there is a change in the entity’s treasurer or governing board member(s).

Ohio Revised Code (ORC) §135.142(C) - The treasurer of the board of education shall prepare annually and submit to the board of education, the superintendent of public instruction, and the auditor of state, on or before the thirty-first day of August, a report listing each investment made pursuant to division (A) of this section during the preceding fiscal year, income earned from such investments, fees and commissions paid pursuant to division (D) of this section, and any other information required by the board, the superintendent, and the auditor of state.

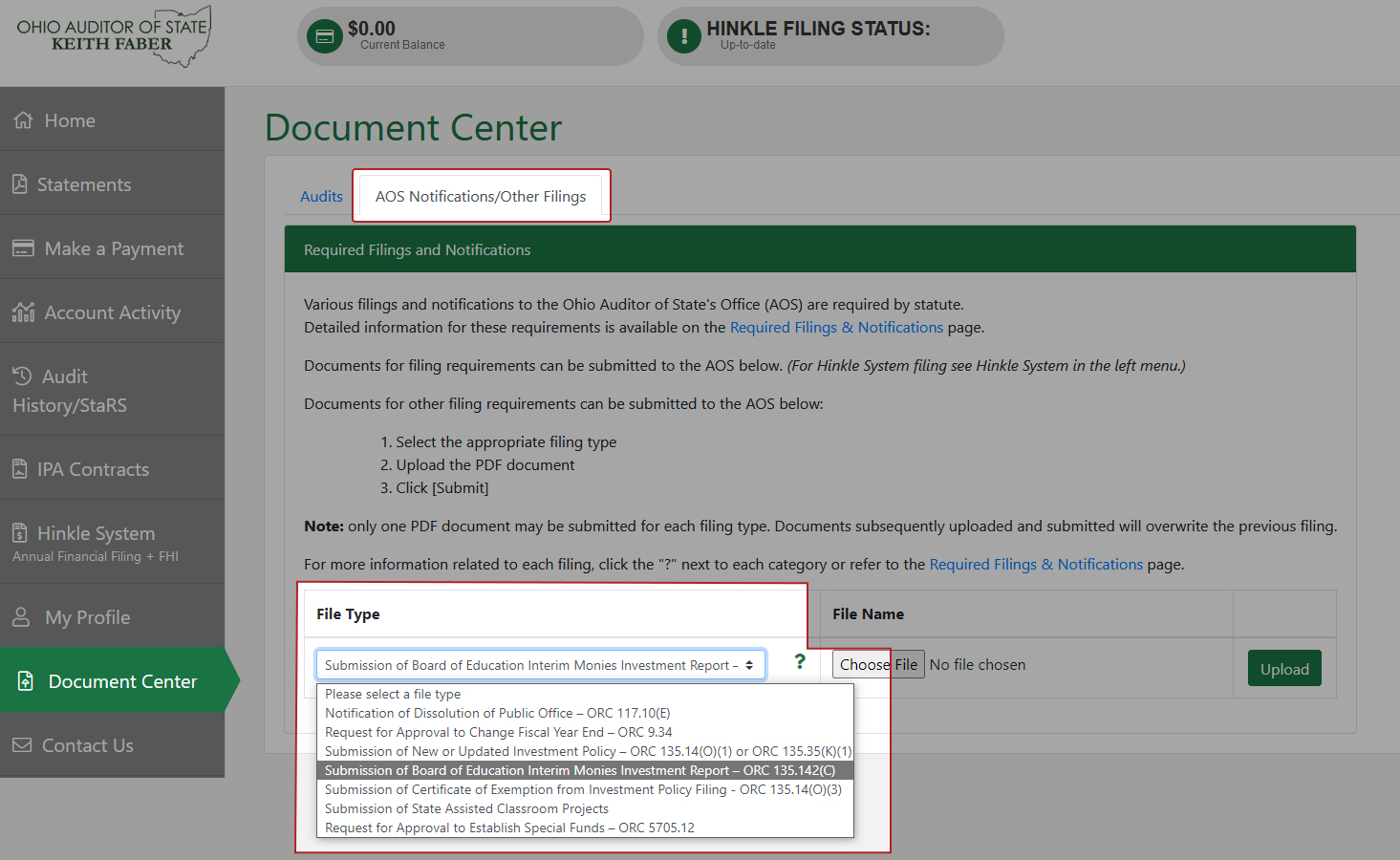

What to do...

To submit your district’s interim monies investment report to the AOS, follow these steps.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of Board of Education Interim Monies Investment Report – ORC 135.142(C)" from the dropdown menu.

- Under File Name find and select your investment report. Then click [Upload] when you are ready to submit.

Continuing Education Requirements

Ohio Revised Code (ORC) §135.22 (E) provides: (E) Division (B) of this section does not apply to any treasurer who annually provides a notice of exemption to the auditor of state. The notice shall be certified by the treasurer of state and shall provide that the treasurer is not subject to the continuing education requirements set forth in division (B) of this section, because the treasurer invests or deposits public moneys in the following investments only:

(1) Interim deposits pursuant to division (B)(3) of §135.14 or §135.145 of the ORC;

(2) No-load money market mutual funds pursuant to division (B)(5) of §135.14 of the ORC;

(3) The Ohio subdivision's fund pursuant to division (B)(6) of §135.14 of the ORC

In other words, if you invest or deposit in those three funds ONLY, you can be exempted from the related training. If you invest or deposit in any other type of fund, you must take the CPIM training.

What to do...

Although ORC §135.22 (E) above indicates a treasurer must provide the AOS with notice of exemption, this requirement is satisfied by the completion of the Treasure of State's (TOS) CPIM Exemption form. A separate notification to the AOS is not required.

How do I file an exemption?

Log into your MyCPIM account and select "Exemption Certification" at the top of the page.

If you need assistance, send an email to CPIM@tos.ohio.gov.

More information is available at the following locations:

AOS FAQs: AOS CPIM Frequently Asked Questions (FAQ).pdf

The Compliance Supplement Manual: 2023 Ohio Compliance Supplement Manual.pdf (Page 214)

Treasurer of State FAQs: tos.ohio.gov/cpim/faq

Fiscal Officer Search: tos.ohio.gov/cpim/fiscalofficers

Establishing Special Funds

Ohio Revised Code (ORC) §5705.12

In addition to the funds provided for by Ohio Revised Code (ORC) §5705.09, 5705.121, §5705.13, and §5705.131, the taxing authority of a subdivision may establish, with the approval of and in the manner prescribed by the auditor of state, such other funds as are desirable, and may provide by ordinance or resolution that money derived from specified sources other than the general property tax shall be paid directly into such funds. The auditor of state shall consult with the tax commissioner before approving such funds.

For further guidance refer to Auditor of State Bulletin 1999-006.pdf

What to do...

- Fill out the Auditor of State LGS Request for Fund Approval Form.pdf

- Save the completed PDF to your computer.

Note: Your save button will vary depending on the web browser you're using.

-

Combine the form with a copy of the legislative authority's resolution requesting

approval to establish the fund.

- Your file must be one PDF. (Attempting to upload more than one file will result in only the last file uploaded being submitted to the Auditor of State.)

- The combined files must be less than 30MB.

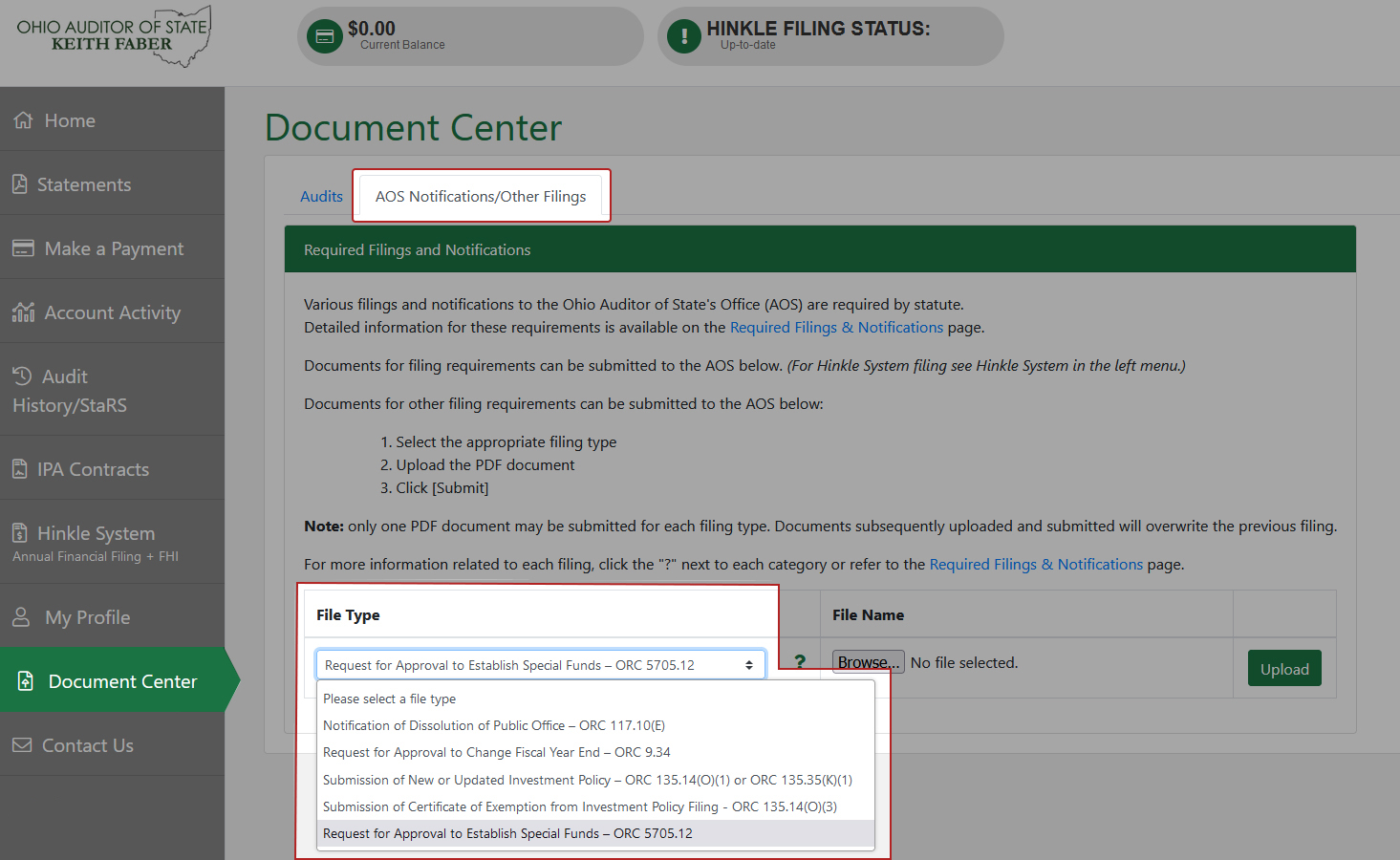

To submit the completed Request for Fund Approval Form and the entity’s resolution authorizing the fund, follow the steps below.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Request for Approval to Establish Special Funds – ORC 5705.12" from the dropdown menu.

- Under File Name find and select your PDF. Then click [Upload] when you are ready to submit.

Note: The AOS Local Government Services division will respond, generally within 30 days of the date of submission, approving or disapproving the fund request.

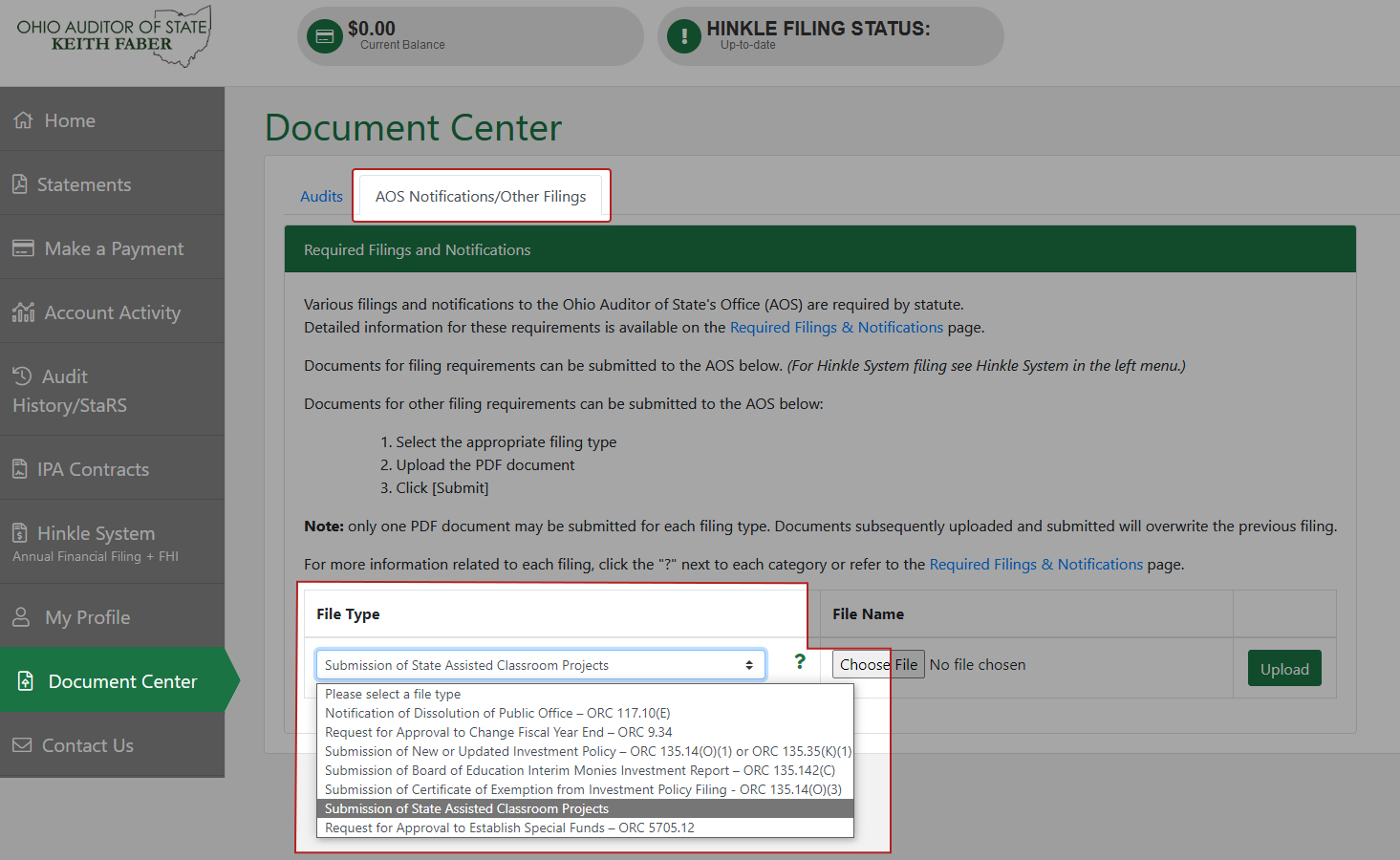

State-Assisted Classroom Projects

Ohio Revised Code (ORC) §3318.051(B) states “On the first day of July each year, or on an alternative date prescribed by the commission, the district treasurer shall certify to the commission and the auditor of state that the amount required for the year has been transferred.”

What to do...

To submit the certification of maintenance set-aside transfer to AOS follow these steps.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of State Assisted Classroom Projects" from the dropdown menu.

- Under File Name find and select your PDF. Click [Upload] when you are ready to submit.

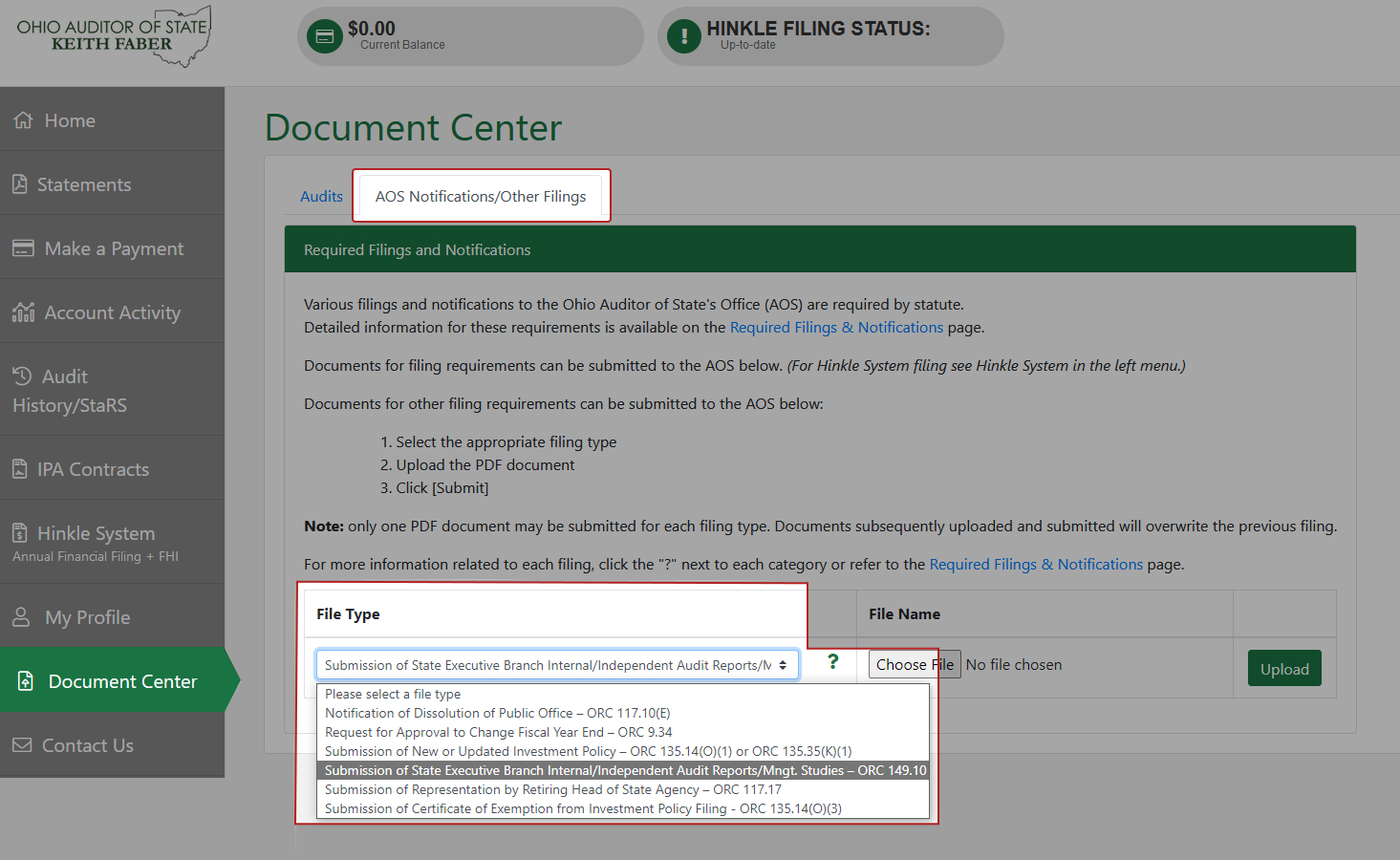

State Executive Branch Reports

Ohio Revised Code (ORC) §149.10 states All boards, commissions, agencies, institutions, and departments in the executive branch of state government shall submit to the auditor of state a copy of each formal internally or independently produced audit report, as well as any management study or report which recommends changes which would affect the auditing system.

What to do...

To submit audit reports/management studies to the Auditor of State’s State Region, follow these steps.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of State Executive Branch Internal/Independent Audit Reports/Mngt. Studies – ORC 149.10" from the dropdown menu.

- Under File Name find and select your PDF. Then click [Upload] when you are ready to submit.

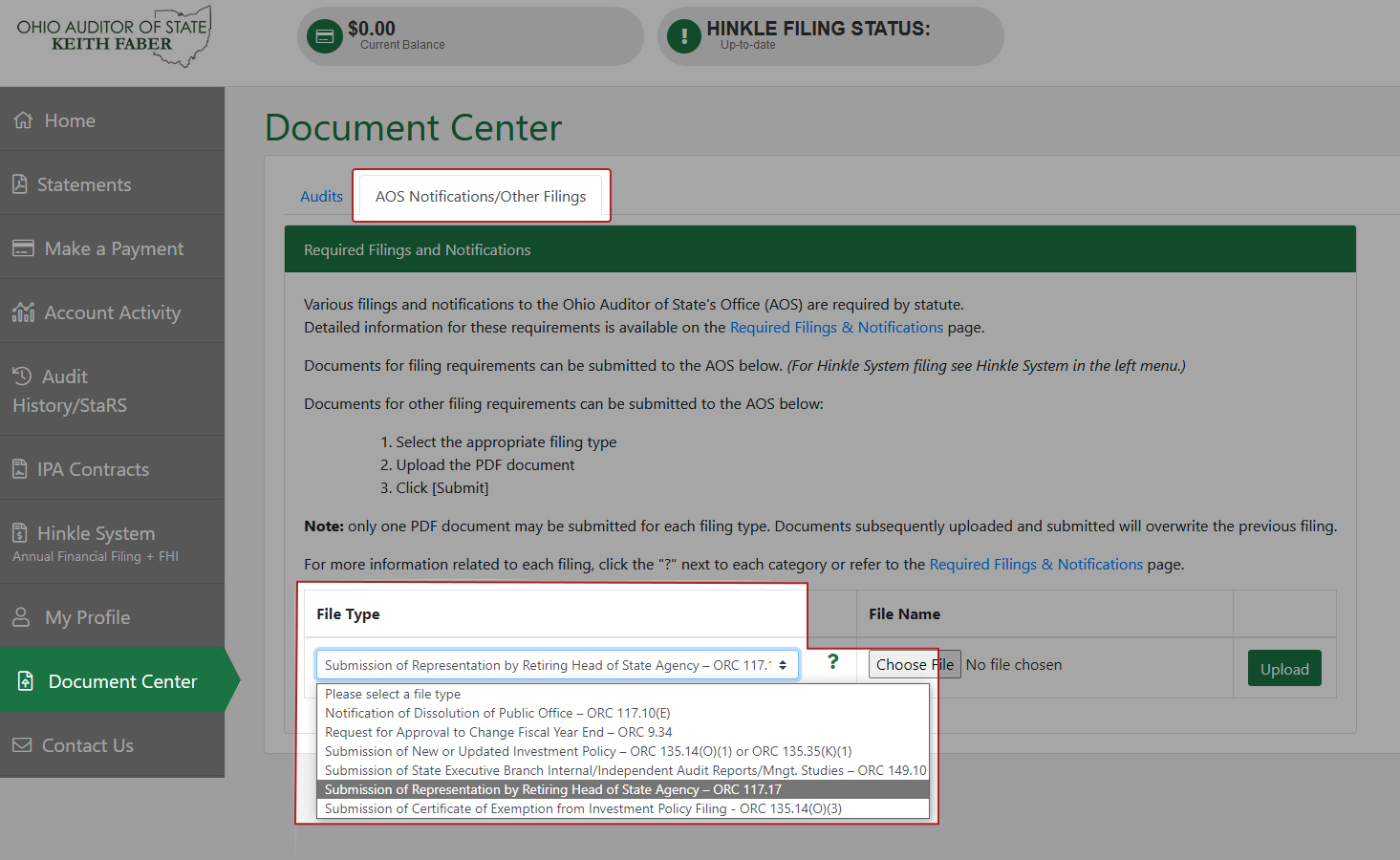

Retiring Head of State Agency

Ohio Revised Code (ORC) §117.17 states before the head of a state agency leaves office, they shall prepare, in the form prescribed by the auditor of state, a letter of representation for the successor in office. The letter shall contain an inventory of all properties, supplies, furniture, credits, and moneys, and any other thing belonging to the state, which it is the duty of such official to turn over to the successor in office or pay into the state treasury. One copy of the letter shall be delivered to the official, one copy to the successor in office, one copy to the governor, one copy to the auditor of state, and one copy to the attorney general.

For further guidance refer to Auditor of State Bulletin 2021-001.pdf

What to do...

You may use this Letter of Representation template (docx) and copy to your agency's letterhead.

To submit the letter of representation to the Auditor of State, follow these steps.

- Log on to your entity’s eServices account.

- Select "Document Center" in the left menu.

- From there, select the "AOS Notifications/Other Filings" tab.

- Then, under File Type, select "Submission of Representation by Retiring Head of State Agency – ORC 117.17" from the dropdown menu.

- Under File Name find and select your Letter of Representation. Then click [Upload] when you are ready to submit.

If you have additional questions send an email to State Region